Background

The traditional estate planning game has been to: (1) ensure client wishes were achieved by drafting wills and trusts such that the assets within the client’s estate served the intended purposes and landed in the hands of the desired beneficiaries, and (2) minimize or eliminate estate (and generation skipping) taxes. Since 2000, a few things have happened: (i) the estate tax exemption has skyrocketed at a rate almost 50 times greater than CPI; (ii) portability, explained below, was introduced in the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (signed by President Obama on December 17, 2010) and made permanent on January 2, 2013 with the signing of the American Taxpayer Relief Act; and (iii) the overall tax gap in the decision making analysis has closed from a 55% estate tax and 15% top long term capital gains rate to a 40% estate tax and 23.8% top long term capital gains rate (including the net investment income tax). Add another 5% for those of us down here in Mississippi.

Attorneys, advisors, and even clients have become habituated over the years in charging blindly forward to avoid the dreaded “death taxes” to the extent they could be avoided at death. However, recent events show that we should step back and think about how the planning environment has changed. Particularly, the focus of this article is to pinpoint an opportunity for planners and clients to focus efforts on maximizing the most efficient usage of the estate tax exemption.

Before we really dive in, it is probably best to define some words we will be using a good bit in this article. Common words we will be using are:

- Taxable Estate – Taxable Estate means the total value of a person’s assets that are subject to taxation upon death. Asset value not taxable by reason of the estate tax exemption are still part of and included in the definition of Taxable Estate.

- Estate Tax Exemption – the Estate Tax Exemption or Exemption, means the exclusion against the estate in IRC § 2010.

- Step-Up – Step-Up means the step-up of income tax basis to fair market value under to IRC § 1014.

Overview

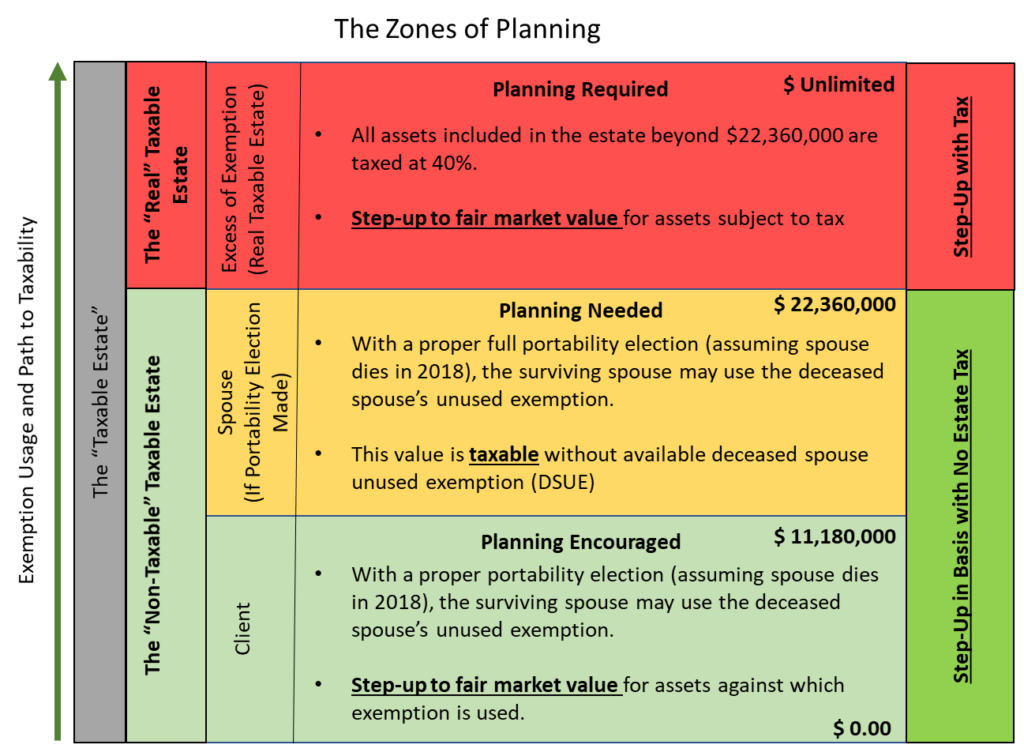

The primary topic of this article is the concept of step-up and the interplay between step-up and the exemption. Ideally, we desire to avoid estate tax while at the same time stepping up the basis of assets to avoid income tax on the sale or taxable exchange of such assets in the future. To have a better understanding of the structure surrounding our planning, please see the figure below:

Maximizing Usage of the Exemption

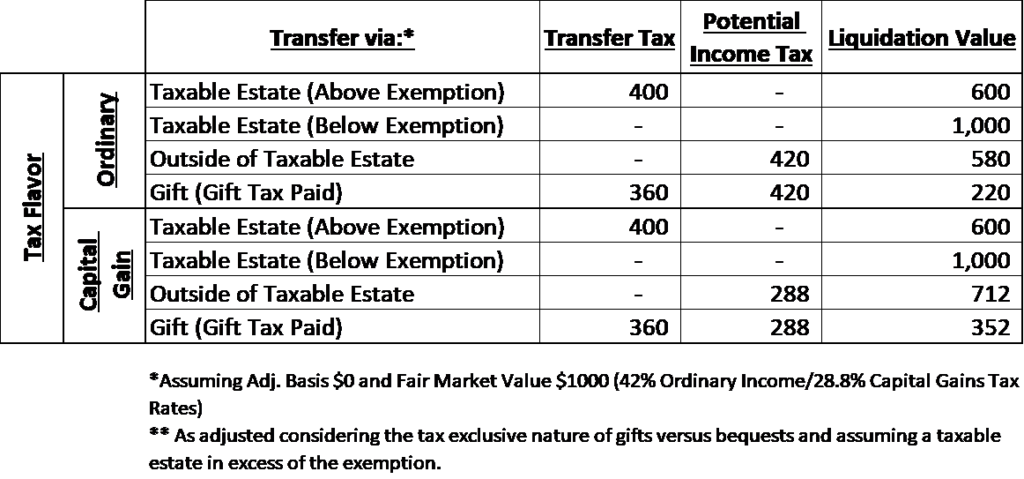

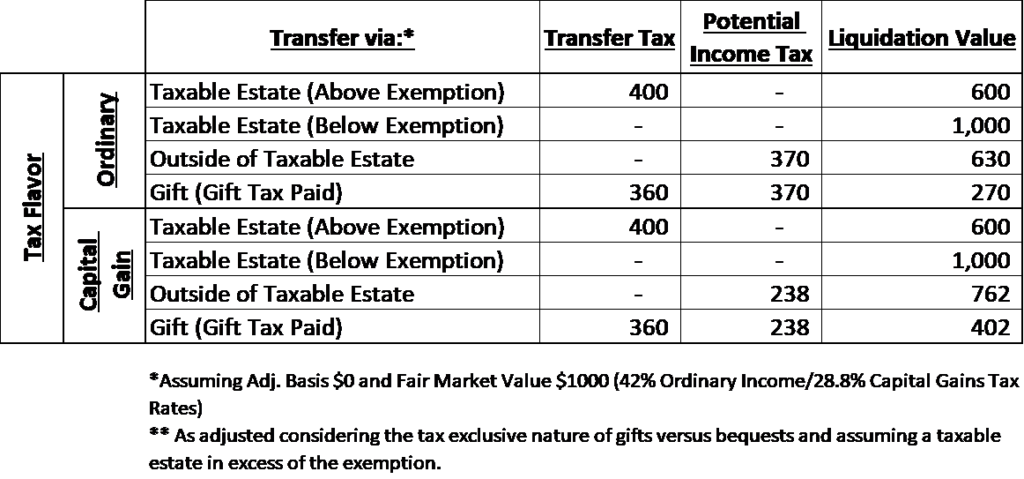

To recap, by including an asset in the taxable estate, it will either use the decedent’s available estate tax exemption or be subject to 40% estate tax. Further, the asset will obtain a step-up in basis to fair market value. Pending the cost basis and the tax rate applicable upon a sale of the asset, the results can vary significantly. For instance, if the asset is a fully depreciated piece of equipment, then the step-up would offset IRC § 1245 recapture gain taxable at ordinary income rates. If appreciated securities held for over a year, then the offset would be against capital gains. Starting on an elementary basis, we will look at a scenario with an asset with $1,000 in value and a $0 basis. Our scenarios will be as follows:

- The asset is depreciated equipment subject to 1245 recapture gain and is:

- Included in the taxable estate where the estate exceeds the exemption;

- Included in the taxable estate where the estate does not exceed the exemption; and

- Not included in the taxable estate; and

- Gifted

- The asset is securities held for over one year and is:

- Included in the taxable estate where the estate exceeds the exemption;

- Included in the taxable estate where the estate does not exceed the exemption; and

- Not included in the taxable estate; and

- Gifted.

For this analysis, we will assume the §1245 recapture rate (ordinary income rate) is 37% and that the long-term capital gains rate is 23.8% (including the net investment income tax). In each scenario, liquidation value means the value of the bequest after imposition of the estate tax that would be applicable, sale of the asset, imposition of income tax applicable to a sale of the asset, and distribution of the proceeds to the beneficiary.

As shown above, in this scenario, there can be value to targeted inclusion into the estate where inclusion is . Further, it is also clear that by including ordinary income recapture property in the estate, there can be a huge tax burden relieved for the beneficiary if the assets were not otherwise subject to step up.

Next, things get more interesting. What if a 5% state income tax is applied? All else equal, there is an obvious yet interesting result. Estate tax inclusion, even in excess of an exemption amount, yields better results than non-inclusion to the extent the potential income tax rate exceeds the estate tax rate. It should be mentioned here that the income tax is not due upon death, but instead is due upon sale or exchange of the property. Again, we are assuming an immediate sale here.

So, based on the above analysis, we can reach four conclusions:

- Step-Up Maximization – It is always more preferential to include appreciated assets in the estate to the extent inclusion does not result in additional estate tax;

- Step–Up Efficiency – It is generally desirable to prioritize estate tax inclusion based upon potential income tax of the asset. While this generally means to target inclusion of ordinary property, there are times where capital gain property may yield better results because of the basis and fair market value differential;

- Estate Tax May Not Always be the Worst Thing – To the extent the ordinary income rates exceed the estate tax rate, if the asset is to be sold or otherwise depreciated in the near future, it may be best to just include and pay the estate tax (state income tax matters) anyways. It is worth noting here that where a beneficiary resides can matter too. In calculating the potential income tax liability, consideration must be given to who the beneficiary is and where the property could be taxed in an eventual sale.; and

- Gift Appreciated Assets Last, if at All – To the extent gift tax is triggered, gifts should be made cautiously after careful consideration and review due to the gift tax and lack of step-up.

Overview of Some Common Existing Plans

Current Common Estate Plans (A/B Formula Plan)

In a typical A/B formula plan, an amount equal to the greater of (i) the decedents estate or(ii) the decedent’s remaining exemption funds a credit shelter trust with the remainder typically going to the spouse or a marital trust qualifying for the marital deduction. These plans need to be reviewed for every client as portability, increases in the exemption, and the narrowing of the tax gap have significantly changed the landscape. Because appreciation could occur between a first and second death, it is possible that the credit shelter assets might not benefit from a step-up at the death of the second spouse to die due to post-mortem appreciation after the death of the first spouse. Considering the many recent changes in the tax laws, we strongly urge everyone to review their plans.

Additional Planning

Clients may also have engaged in planning using irrevocable trusts, family limited partnerships, and prior gifting to minimize estate tax liability. It is here where an opportunity to re-optimize estate plans exists.

- Irrevocable Trust – Without going into detail on the intricacies of planning with the many types of irrevocable trusts that exist, most have with one primary purpose, removal of assets from someone’s taxable estate. Due to changes in the tax law, it may be that the value of assets removed from one’s taxable estate and into an irrevocable trust could be added back into that same person’s estate with no additional estate tax being due upon death.

- Family Limited Partnerships – Commonly, family limited partnerships are used to facilitate more efficient gifts and to diminish estate values. Like with irrevocable trusts, it is possible that this value diminishment is no longer necessary and may even be detrimental to one’s plan.

- Gifting – Gifting is popular for a number of reasons, including because it is possible for individuals to gift an amount equal to the annual exclusion (currently $15,000) each year and for a married couple to gift an amount equal to double the annual exclusion each year to as many individual people as desired. Further, it is possible to avoid the estate tax inclusive nature of the estate tax (i.e. paying tax on the money with which you pay tax).

John Smith, Sr. and the Old Trust – A Hypothetical Case Study – A Prudent Client Walks In

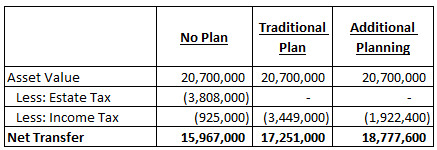

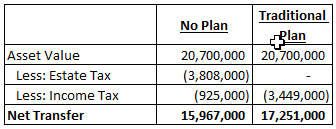

John Smith, Sr., a prudent man, visited his estate planner years ago. At his estate planner’s recommendation, an irrevocable trust was formed to sell assets out of Mr. Smith’s estate in exchange for a promissory note which has since been paid off. The trustee has been extremely successful in managing the trust assets. Mr. Smith no longer has a taxable estate. Without planning, Mr. Smith’s holdings would have been as follows:

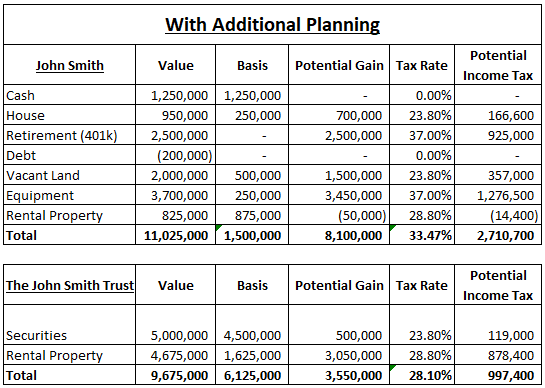

Due to planning, Mr. Smith’s estate planning situation is instead as illustrated below:

Reviewing the above, this is a good result, assuming estate tax avoidance was Mr. Smith’s only concern. He owes no estate tax upon his death and a vast majority of his assets are in trust. At this point, Mr. Smith might be told he has done a great job and to enjoy his success knowing he has successfully planned around estate tax. However, there is still a lot more potential.

In a liquidation scenario, post-death, Mr. Smith’s estate would be sitting about $3.81 Million ahead from a net asset transfer perspective due to the initial planning performed by Mr. Smith. However, Mr. Smith’s beneficiaries will still be looking at approximately $3.45 Million in potential income tax upon and an eventual sale.

At this juncture, Mr. Smith is curious what else can be done considering the new tax law.

At this juncture, Mr. Smith is curious what else can be done considering the new tax law.

How to Plan for the Increased Exemption and Step-Up

There are several ways to achieve a maximized benefit from the newly increased exemption amounts in tandem with basis step-up. All of the methods described in this article involve some type of intentional and targeted (sniper-shot) inclusion. However, while previous planning focused on blanket exclusion, this planning differs because any over-inclusion can result in potentially unwanted tax liability. Some ideas to maximize this step-up are as follows:

- Re-Tooling that Irrevocable Trust – Introducing a general power of appointment, including a general power subject to a formula may be a useful tool. Assets subject to a general power of appoingment held by a decedent are included in his or her taxable estate and thus receive a step up in cost basis.1 The general power of appointment could be over certain assets, a percentage, or dollar amount of the assets in the trust. As a planning point, being asset specific may yield better results as it is possible in that scenario to prioritize the most tax advantageous assets.

- Changing the Family Limited Partnership – Previously, discounting was a major benefit for family limited partnerships. What if that discount now causes lost step-up? It may be time to revisit partnership agreements. Further, given step-up, it is worthwhile considering the benefits of a 754 election and the triggering events surrounding such an election such that the partnership can receive an internal basis adjustment in tandem with the step-up of the outside basis of the interests that were held by the decedent.

- Regifting/Upsteam Planning – It is possible, though one must navigate the 1-year lookback under 1014(e), to fund a trust with assets and confer a general power over those assets to an aging family member such that inclusion is triggered in the family member’s taxable estate further triggering a step-up in basis. One trust structure which accomplishes this is known as an upstream sale to general power of appointment trust (UpSPAT).

Back to Mr. Smith

With respect to Mr. Smith, an opportunity exists to try to get assets back into Mr. Smith’s estate. Ideally, this would be done on an asset by asset basis. However, how might one identify which assets to include? There has to be some mechanism to determine tax efficiency. While not perfect because it does not assume when an eventual sale and recognition event will occur, an easy way to prioritize, though perhaps not the best way to prioritize, is to divide the potential income tax by the fair market value of the assets to determine the amount of potential income tax offset for each additional dollar included in the estate. This prioritization focuses on the highest efficiency of step-up utilization. In other words, the highest potential income tax (not rate) items are targeted first.

Accordingly, if Mr. Smith, possessed a general power of appointment over the equipment, vacant land, rental property, and some of the securities, Mr. Smith’s beneficiaries could enjoy and benefit from approximately $1.5 Million in potential income tax savings.

The planning involved would incorporate modifying the trust in such a way Mr. Smith could hold a general power over those assets either directly, or even better, through a formula.

Comparing all scenarios, Mr. Smith makes a significant improvement with additional planning.

Conclusion

In closing, it is imperative that in the wake of the passing of the Tax Cuts and Jobs Act2 that estate plans be reviewed. It may be that, due to the significant increase in the exemption, a large amount of unnecessary income tax may be waiting in the future that could be avoided. The step-up achieved because of the estate tax exemption is free money that is easy to miss.

Footnotes

- See IRC §§ 1014, 2041

- The short title “Tax Cuts and Jobs Act” was removed, but the Act may continue informally to be referred to by that former and commonly used name. The official title is “To provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.”