Nelson: Formula Clauses and Getting Exactly What You Ask

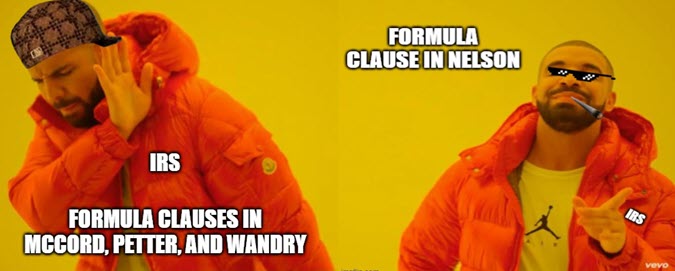

It’s common knowledge among tax practitioners that the IRS is not a fan of formula gift clauses that attempt to pin the amount of the gift to a dollar figure such that the actual gift is adjusted in the event of a successful valuation challenge by the IRS.[1] However, in a recent Tax Court case,…

Read More