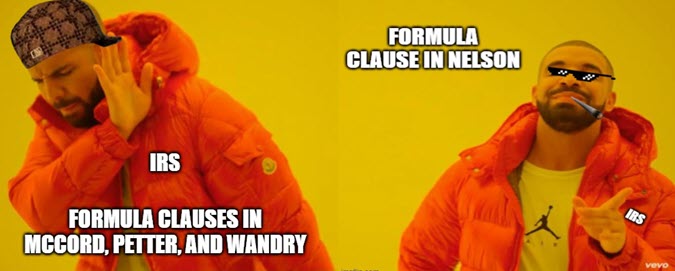

Retroactive Reduction in the Exemption Amount: Is it Likely? Can it Happen? Ideas to Plan for it in Case it Does

As result of the special runoff in Georgia for their two senate seats, the Democrats will now hold power in the Senate, the House, and the Presidency following President-Elect Joe Biden’s inauguration on January 20th. With the Democrats controlling the Presidency, the House, and the Senate, many have started to wonder what tax changes may…

Read More